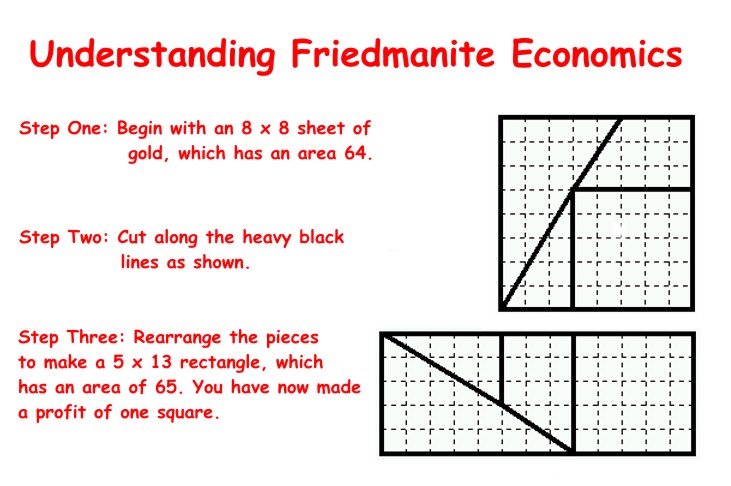

Milton Friedman was a well-known American economist, a proponent of an economic philosophy that is growing in popularity in this country. In practice, it works something like this:

Need a real-life example? Do mortgage-backed securities ring a bell? Or for a more locally-relevant example, the price of fuel, which the oil companies will swear up and down is at the mercy of the conditions of the free market (and therefore needs to be raised regularly), yet oddly will reduce immediately by the same amount they just raised them when someone in the government publicly airs some skepticism about it.

| SUPPORT INDEPENDENT SOCIAL COMMENTARY! Subscribe to our Substack community GRP Insider to receive by email our in-depth free weekly newsletter. Subscribe to our Substack newsletter, GRP Insider! Learn more |

When it comes to your money, beware of theories that seem to clash with common sense. 64 really doesn’t equal 65 after all.

I write a column for The Manila Times on Tuesdays, Thursdays, and Saturdays. Most of the energy sector and the heads of several government agencies probably wish I didn’t.

Oh wait. So you disapprove of Milton Friedman’s policies? Which part the lack of government regulation and weak anti-trust regulation or just unrestrained Capitalism?

I specifically remember that puzzle.

There aren’t really 65 squares. Rather the angle at which the pieces of cut creates an ultra-thin gap through the middle of the long diagonal with a total area of one square, when the pieces are reassembled.

Julian Assange, despite being an egomaniac, did put it right when “free markets only work when they are forced to be free.” Free or “not,” there needs to be a system that will prevent the sort of abuse by either government or the businesses they let in.

Markets, after all, are there to serve the people. Quoth Adam Smith.