Amidst the political turmoil that continually pervades our country, a strong and passionate plea reverberates among the mouths of the marginalized. Amidst the slums of the Philippines echoes the unswerving determination of the less-fortunate to assert what they want from the government, as shown by the series of protests conducted by advocacy groups across the Philippines. And on the advent of the “Noynoying†craze, the wishes of such organizations became more heard and recognized across the different sectors of society.

Recently, there have been demonstrations led by student organizations and the transport group PISTON (Pagkakaisa ng Samahan ng mga Tsuper at Opereytor Nationwide), in retaliation to the incessant hikes in oil prices, which greatly hamper the livelihood of the workers. Aside from the abolition of the Oil Deregulation Law, which provides the private sector the right to handle the entirety of the oil industry in the Philippines, the protesters demand, as a part of their advocacy, a substantial increase in their wages. The demand for a 125-peso daily wage increase for workers become more and more pressing as the protesters become more and more assertive in their fight against what they consider as government negligence of citizen welfare. As the battle for rights and welfare rages on, it is important that we pinpoint the intricacies of the current issue regarding oil prices and wages, in order for us to shed some light to what must be done to sufficiently address the crisis. Let us begin with the first problem; what of oil price hikes?

| SUPPORT INDEPENDENT SOCIAL COMMENTARY! Subscribe to our Substack community GRP Insider to receive by email our in-depth free weekly newsletter. Opt into a paid subscription and you'll get premium insider briefs and insights from us. Subscribe to our Substack newsletter, GRP Insider! Learn more |

Go take a hike

Oil price hikes have always been viewed as a moral evil in this country. It is said to be the manifestation of the corporations’ greed as they feast upon the people’s fruits of labor. The hate rises exponentially when oil prices just keep on rising without any noticeable rollbacks, and this idea constitutes the backbone of the protesters’ complaints. This, according to them, is the reason why people sink lower and lower in poverty. The logic is straightforward; workers, most of which are dependent on oil for their livelihood, earn less when oil price shoots up, giving less food on the table. It’s time to put their reasoning to the test.

(Source of data: Link)

(Note: For the purposes of this article, I shall expound more on diesel gas. Also, the figures and calculations involved are mere estimates to provide a clear picture and shouldn’t really be taken as solid and factual statistical data.)

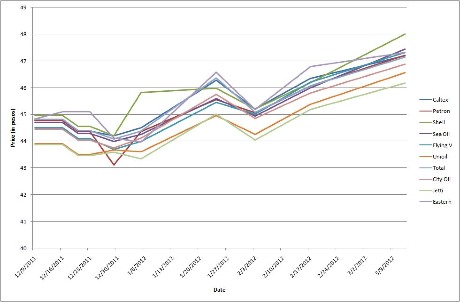

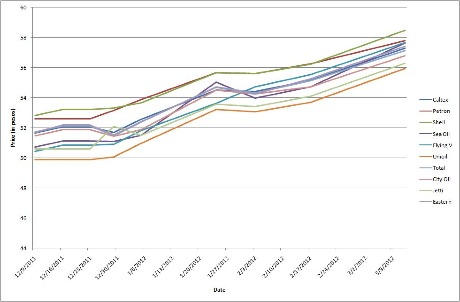

I took the liberty of providing a little graph of the oil price trend (diesel and unleaded) from December 9, 2011 to March 12, 2012.

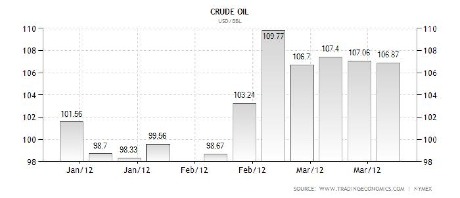

Here, we see the steady increase in oil prices in the Philippines. It seems that the claims of the protesters are substantiated; the prices really are rising. The next question is, why does this happen? Here I shall attempt to hazard a theory regarding the intriguing trend of our national oil prices by considering the world price of crude oil, a major component of gasoline, from January to March 2012.

You can see that, except possibly for the duration of March, the world oil price has been more or less flexible and dynamic for this time period. One might naturally expect that, ideally, oil prices country-wise should be as flexible and dynamic to correspond to the world price of oil. Even in the consideration of a delay (since no commodity is perfectly elastic, which in economics means “readily adaptable†to changes in supply and/or demand), people will expect that national pricing will eventually catch up to the global norm. However, this is certainly not the case in the Philippines. As we have witnessed, our oil prices steadily rose without a significant rollback. For all intents and purposes, this finding leads us sufficiently close to a legitimate conclusion; our oil prices are being artificially raised.

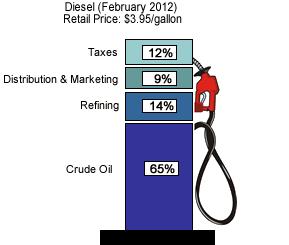

An estimate supports this conjecture, although not perfectly conclusively. Here we have a breakdown of what the United States pay for their diesel.

(Source: Link)

This means that the US pays approximately $2.57 per gallon for the crude oil alone. This follows that refining, distribution and marketing as well as taxes impose an additional $1.38 per gallon on the citizens’ gasoline expenses.

Now, it is safe to say that crude oil constitutes 65-70% of our diesel gasoline. Suppose, for the sake of the argument, that we follow the same formula for the breakdown of our gas expenses. As of mid-March 2012, the world crude oil price is around $106.87 per barrel. This is equivalent to around $0.67 per liter of crude oil, or approximately Php 28.80 per liter. Say crude oil comprises 65% of our diesel. This means the estimate for the actual price we pay for diesel would be approximately Php 44.30. It follows that we are to pay around Php 15.50 for miscellaneous fees.

Meanwhile, if we take the price of our diesel from Shell at March 9, which is Php 48.00, 65% of it would be Php 31.20, and the miscellaneous fees Php 16.80. Assuming that our primary assumptions hold true, the price we pay for the crude is overpriced by Php 2.40, while our miscellaneous fees are overpriced by around Php 1.30. Shell basically charges us approximately Php 3.50 than what we should actually pay for. You can check the other parts of the trend of the diesel and see that the national price for diesel is overpriced in some way. (Just note that the global price of oil is not anchored at $106.87 per barrel. It changes alongside with our national oil price.)

Are profits bad?

MEN, GRAB THY PITCHFORKS AND BURN THESE WRETCHES TILL THEY MINGLE WITH THE CRIMSON GLOW OF THE MIDNIGHT FLAMES!

But, before we get overexcited over this, let us contemplate on the possible legitimacy of their actions, namely, profiteering as a normal business function.

In one of my Facebook notes, I explained (albeit unprofessionally) the ill effects of abolishing profiteering in the normal business cycle.

1. Businesses are created for the purpose of making profits.

The primary motivation of a person to create a business is to make profits; to be rich. A business which is not interested in making profits is not even a business to begin with, but a charitable organization. To deprive businesses of their innate function is totalitarian and anti-rights, since you basically infringe one’s right to freedom and property. I wouldn’t go as far as to assert that profiteering is moral (unlike some right-wing fanatics), since profiteering is an innate function of a business; it’s what business is all about. Otherwise, we might as well contemplate on the morality of the refrigerator’s innate function, which is refrigeration (duh).

2. Profits are behind the countless innovation we enjoy today.

Where else would businesses get the funds to come up with better and more sophisticated products for the benefit of the consumers? Profits are important for the existence of businesses, simply because they keep businesses in existence. Furthermore, profits make businesses grow. The reason why companies give you more and more goods is because they have more money to make use of.

Suppose that a businessman is doing, well, business in a nation where profiteering is banned. He brought some stuff to the market and sold them, but because profiteering is banned, he is still left with nothing but his capital. As a result, no matter how much stuff he sells, he will always end up with his capital. Therefore, he doesn’t have the means to, say, expand his shop, or come up with better products, since he doesn’t have the funds to do so. To take money from your capital in this kind of society equates to incurring a loss, since you end up with less capital than you began with, with no hopes of getting it back through profits. You see, to combat profiteering is to combat progress.

3. Profit is a critical indicator of consumer demand.

Some people might suggest that, given the catastrophic consequences of abolishing profits, we should at least control profiteering through government bureaucracy of some sort. However, doing this is almost as bad as not allowing any profits in the first place. This is because profits serve as signals for consumer demand, and, ultimately, pricing.

Going back to our unfortunate businessman: deprived of profits, the businessman not only runs the risk of incurring multiple losses, but is also essentially blind in the market he’s in. Where should he invest? Should he invest in new products? Should he buy more cucumbers than cabbages? Since he’s deprived of profits, he just ends up with his capital (if he doesn’t incur losses in the process), and so he doesn’t know what will benefit him best. What’s worse, this will also lead to his failing to provide what benefits consumers best. For all intents and purposes, he might just keep the status quo and keep selling the same quantity of goods, since vegetables have differing prices, and buying more of one type of a pretty pricey vegetable might shrink his capital, making him weaker as an entrepreneur. This results to a stupendously inelastic supply. But demand is dynamic; people might want more cucumbers and less cabbages and vice-versa. A rigid supply (the businessman’s goods) would reduce the efficiency of the market. In this case, there would be a deficit in cucumbers and surplus in cabbages. Unsold cabbages, which are perishable goods, spell yet another loss in the businessman’s behalf. People, meanwhile, will be less satisfied since their demands aren’t met. The economic interactions are rough and unhealthy. What’s worse, since businesses are deprived of their profit-glasses, they are blind to consumer demand, which means they’re also blind to proper pricing. This may then lead to under-priced products (loss in capital) or over-priced products (inflation). We now see that profits are not only incentives, but also signals for a smoothly flowing economy.

However, another dilemma remains unsolved. While profiteering under normal and just conditions is not only normal but essential, this does not explain why national pricing hardly follows the global trending of oil. Does this mean we can go back to our pitchforks and assert what we want?

Objection!

Now, this answer might put me at odds with most sympathizers of the marginalized sector… but I object. This is because the Left’s unswerving dedication to the welfare of the “proletariat†produced a damaging misconception; a misconception that I would call the “price-wage dichotomy.â€

This false dichotomy might stem from another critical misconception; that we can point out in a particular market in an absolute manner, the producer and the consumer, the giver of supply and the giver of demand. Given this kind of market perspective, we can easily set the businesses as the producers and us citizens as consumers, since this at face value seems to be the obvious setup; the businesses provide the goods and we buy them. From this perception, it is easy to conclude that any rise in prices means producers are getting greedy.

But this kind of viewpoint is dangerously simplistic. This is because first and foremost, all of us are human. Since we’re all human, we all need to consume. In order to consume, we all need to buy something. The same principle applies to selling. Businesses become consumers at some point in buying their supplies before becoming sellers to us “consumers.†Therefore, there’s no such thing as a producer and a consumer in an absolute sense. We all become consumers and producers relative to a specific business transaction.

So how exactly do we, laymen, become producers? This is where we shatter the price-wage dichotomy; we become producers because of wages. Our product is our labor, and wage is our price. Given the relative roles of each and every one of us in business transactions, this fact dissolves the notion of the difference between prices and wages. They are basically the same thing. So what is the implication of this idea to the pleas of the marginalized sector and my earlier objection?

So suppose the demands of the protesters were granted; the government implements the 125-peso wage increase and a moratorium on oil price increase on top of that. The workers are happy, and the businesses obviously are not. Big businesses aren’t happy because they aren’t going to get much profit than they used to, and the protesters would think they finally got what they deserved and even got back on the oppressive capitalists. However, there is an unseen variable in this scenario, one that will vividly depict what’s going to happen; the small businessmen.

Needless to say, small businessmen might not be able to cope up with the double punishment delivered by the protesters. Let’s think of these small businessmen as the customers, while the workers become the sellers. Basically, the sellers just put a sharp increase on the price (wage) on their product (labor). Furthermore, they put a stopper on the wage (earnings) of these businessmen. When you end up with less wages and higher prices, what would you normally do? You buy less.

Businessmen are also consumers of labor. When faced with high cost of labor and lower earnings, they are forced to buy less labor. This is true especially of businessmen. This means not every worker gets the benefit of the wage increase. In fact, some workers end up taking the fall for the benefit of the lucky folks. And usually, as history shows, it is the unskilled workers that take one for the team.

Milton Friedman explained the dangers of minimum wage law, calling it the most anti-negral law in American history, which is effectively shunning unskilled to semi-skilled workers from getting jobs. Since the cost of hiring them rises, employers will naturally hire fewer workers, like the way we buy less stuffs when the prices of those stuffs rise. After all, no one’s obliged to buy anything; this principle goes both ways.

Thus we have disproved the price-wage dichotomy and laid the foundations on the hidden dangers of indiscriminate wage increases and moratoriums on commodity prices. But then, the problems remain; oil prices still rise, and the workers remain the poor suckers. If wage increase is not the best solution, what is?

It is in times like this that we must apply what the good lawyer Phoenix Wright does; think outside the box. What else could possibly catalyze these sad events in our economy?

A Dangerously Insulated Market

I shall once again hazard a theory, although this one’s not really devoid of a basis. In all probability, the root cause of this disparity between the rich and poor in our country… is the government.

For more than 25 years, we have been living under a strongly protectionist market, thanks to late and former president Corazon Aquino’s 1987 Constitution. The economic provisions in this law impose a 60/40 split between the ownership of the majority of businesses in the Philippines if foreign ownership is involved; 40% for the budding foreign investor, and 60% for a Filipino business partner.

(Source: Link)

But isn’t this a good thing? The Filipinos still benefit more from the transaction, so we should be okay, right?

Unfortunately, it doesn’t mean that every Filipino will benefit from protectionism just because a handful does, contrary to conventional Filipino belief. In fact, Philippine protectionism gave our big local businessmen a free pass to actually exploit us, the consumers.

1. Notice the increasingly degrading quality of products and services in our country (faulty electric wires, dismally slow internet connection, etc.), coupled with the unprecedented rise in prices. This is because our market is insulated from any further competition (e.g., foreign competitors). The local businessmen, the only big boys in town, deprived of any worthy rival; what do you think they’ll do to maximize their profits? To cut back on spending and raise prices at will. Cutting back on spending not only degrades the quality of products and services, less labor will also be required, equating to massive layoffs. To add insult to injury, higher prices will restrict the people’s purchasing power even more. But these two will maximize profiteering of the local businessmen. And this, more or less, is what’s happening right now.

2. Protectionism can explain the unusual oil price trend in our country. Since our market is insulated by the economic provisions in the current Constitution, local oil businessmen (the oil companies in the Philippines are interdependent), are free to raise the prices at will without any significant rollback. After all, we have no choice but to buy from them, since we’re very dependent on oil. This is the twisted version of profiteering; irrational protectionism mutates the concept of profit, which is merely a market signal, into a tool of evil according to the Left’s rhetoric. Should a totally independent competitor (most likely abroad) join the fray, the first rational idea it would come up with is to sell cheaper oil. Our market, fed up with high oil prices, will naturally go for this new rival, leaving the local businessmen to bite the dust. As more and more rivals join the field, offering cheaper oil, the local businessmen will then be forced to drive their prices down as well, lest they lose everything to the new rivals. This is the advantage of free competition; everybody sells, everybody can buy. Everybody wins. Unfortunately, some people in office may have ulterior motives for keeping the status quo, to the detriment of the people he vowed to take care of.

A plausible stepping stone to escape from this mess, though improvable, would be to scrap the protectionist provisions of our Constitution on oil, in order to suppress the ill effects of exploitation from the local businessmen. Let the profits liquidate and even out through business competition, while at the same time, ensuring that people get optimum goods and services. This seems to be one crucial step in addressing the olden dilemma of commodity prices in the Philippines. The system is the enemy; not the prices, not oil. It’s the “system.â€

This video sums up the idea in this article quite nicely; the dangers of indiscriminate wage increases and the wonders of unhampered competition. (Note: the minimum wage law can be seen as an increase in wages)

So it seems that the protesters were right in saying that oil price hikes in this country are brought about by greed from the big businessmen. However, they might have left out a few crucial details in demanding a moratorium on oil prices and a significant increase in their wages. It is essential we really think things through when demanding change, whether this change will truly serve everyone’s benevolent interests, whether this change is really for better or worse. The small details do matter.

All I want to say is that… “Be careful with what you wish for.â€

Pretty nice job on that topic, really.

Thank you very much! 😀

Oil companies in the Philippines are interdependent, this is true, but aren’t they all multinational corporations? How is the market protected from foreign competition? What if we source oil from Venezuela or Indonesia, would oil be cheaper, or do the multinationals still dictate oil prices? Is the price of oil in the Philippines higher because of VAT? I believe this is the bone of contention between the government and the so called “marginalized groups”.

Yes, major oil companies here in the Philippines are also multinationals. However, note that big Filipino businessmen own a large portion of these companies, something that is mandated by our Constitution.

Furthermore, there are lots of oil companies around the world. You can check http://www.subsea.org/company/allbyregion.asp

to see just how many oil companies there are in Europe alone.

It is implied therefore that the Constitution works in such a way that only selected big oil companies are able to business here for the benefit of the oligarchs, while the rest of the competition is shunned away.

If we source oil from Venezuela (Indonesia has relaxed its cheap oil policy, I believe), there’s a big chance that we’ll have to pay much more. This is because oil companies are forced to drive down their prices. So, in order to make up for the loss, they will probably charge other purchasers more.

As to the global oil pricing, this is affected by a whole bunch of factors; the price oil companies want, the demand of countries, the remaining supply, government policies, etc. One can’t really say that oil companies solely dictate the pricing.

Also, I believe the extra fee we pay due to VAT is included in the miscellaneous fee we pay when buying gasoline.

My point is this; the global oil price trend is more or less the best gauge of value of oil, and it is advisable that we allow our oil market to adapt to this trend as efficiently as possible. This can be done by relaxing the constraints in our market, to let more companies participate. An increase in oil suppliers will more or less evenly distribute the earnings of the companies, because people will have more choices.

Most of all, our market will be more sensitive to the global oil price trend, which will ensure that what we pay is what we should pay. Although I’ve noted that no commodity is perfectly elastic, this is the best recourse I can come up with.

Yes, major oil companies here in the Philippines are also multinationals. However, note that big Filipino businessmen own a large portion of these companies, something that is mandated by our Constitution.

Furthermore, there are lots of oil companies around the world. You can check http://www.subsea.org/company/allbyregion.asp

to see just how many oil companies there are in Europe alone.

It is implied therefore that the Constitution works in such a way that only selected big oil companies are able to business here for the benefit of the oligarchs, while the rest of the competition is shunned away.

If we source oil from Venezuela (Indonesia has relaxed its cheap oil policy, I believe), there’s a big chance that we’ll have to pay much more. This is because oil companies are forced to drive down their prices. So, in order to make up for the loss, they will probably charge other purchasers more.

As to the global oil pricing, this is affected by a whole bunch of factors; the price oil companies want, the demand of countries, the remaining supply, government policies, etc. One can’t really say that oil companies solely dictate the pricing.

Also, I believe the extra fee we pay due to VAT is included in the miscellaneous fee we pay when buying gasoline.

My point is this; the global oil price trend is more or less the best gauge of value of oil, and it is advisable that we allow our oil market to adapt to this trend as efficiently as possible. This can be done by relaxing the constraints in our market, to let more companies participate. An increase in oil suppliers will more or less evenly distribute the earnings of the companies, because people will have more choices. Although I’ve noted that no commodity is perfectly elastic, this is the best recourse I can come up with.

Yes, major oil companies here in the Philippines are also multinationals. However, note that big Filipino businessmen own a large portion of these companies, something that is mandated by our Constitution.

Furthermore, there are lots of oil companies around the world. Not just Shell, Caltex, Petron, and others.

It is implied therefore that the Constitution works in such a way that only selected big oil companies are able to business here for the benefit of the oligarchs, while the rest of the competition is shunned away.

If we source oil from Venezuela (Indonesia has relaxed its cheap oil policy, I believe), there’s a big chance that we’ll have to pay much more. This is because oil companies are forced to drive down their prices. So, in order to make up for the loss, they will probably charge other purchasers more.

As to the global oil pricing, this is affected by a whole bunch of factors; the price oil companies want, the demand of countries, the remaining supply, government policies, etc. One can’t really say that oil companies solely dictate the pricing.

Also, I believe the extra fee we pay due to VAT is included in the miscellaneous fee we pay when buying gasoline.

My point is this; the global oil price trend is more or less the best gauge of value of oil, and it is advisable that we allow our oil market to adapt to this trend as efficiently as possible. This can be done by relaxing the constraints in our market, to let more companies participate. An increase in oil suppliers will more or less evenly distribute the earnings of the companies, because people will have more choices. Although I’ve noted that no commodity is perfectly elastic, this is the best recourse I can come up with.

On TEDtalks. come, there is a video on how Germany has been able to slowly wean itself from dependence on fossil fuel and nuclear power. The Philippines, being a developing country without a highly-structured national grid that delivers electricity to its people can take advantage of a small and medium-sized power station to distribute energy from renewable sources. Why haven’t we moved towards that direction? You are right, this is probably because of the protectionist provisions in our constitution. The oligarchs are choking us to death through their profiteering business practices, in their dominant ownership of power companies in the country.

It is indeed time to liberalize the energy sector and let other multinationals help us meet our energy needs through renewables (wind and solar)at competitive prices. Germany doesn’t have much sun and is not very windy and yet they are able to generate power to meet 20% of their energy needs from these sources. Green technology could be shared by German companies in the Philippines, if only the oligarchs will step out of the way. Go Philippines, go green. . .

Answering your previous Q’s:

Yes, major oil companies here in the Philippines are also multinationals. However, note that big Filipino businessmen own a large portion of these companies, something that is mandated by our Constitution.

Furthermore, there are lots of oil companies around the world. You can check http://www.subsea.org/company/allbyregion.asp

to see just how many oil companies there are in Europe alone.

It is implied therefore that the Constitution works in such a way that only selected big oil companies are able to business here for the benefit of the oligarchs, while the rest of the competition is shunned away.

If we source oil from Venezuela (Indonesia has relaxed its cheap oil policy, I believe), there’s a big chance that we’ll have to pay much more. This is because oil companies are forced to drive down their prices. So, in order to make up for the loss, they will probably charge other purchasers more.

As to the global oil pricing, this is affected by a whole bunch of factors; the price oil companies want, the demand of countries, the remaining supply, government policies, etc. One can’t really say that oil companies solely dictate the pricing.

Also, I believe the extra fee we pay due to VAT is included in the miscellaneous fee we pay when buying gasoline.

My point is this; the global oil price trend is more or less the best gauge of value of oil, and it is advisable that we allow our oil market to adapt to this trend as efficiently as possible. This can be done by relaxing the constraints in our market, to let more companies participate. An increase in oil suppliers will more or less evenly distribute the earnings of the companies, because people will have more choices. Although I’ve noted that no commodity is perfectly elastic, this is the best recourse I can come up with.

——————————

Indeed, I believe it would be best to liberalize the oil industry. However, to cope up with the looming global oil crisis, I also strongly suggest that we start looking for alternative energy sources at the same time. Liberalizing our oil industry is a stepping stone, not the coup de grace, to our energy crisis.

Indeed, I believe it would be best to liberalize our oil industry. However, to cope up with the looming global oil crisis, I also strongly suggest that we start looking for alternative energy sources. Liberalizing our oil industry is a stepping stone, not the coup de grace, to our energy crisis.

Oh dear, sorry. Multiple posts. :/

Arche, your ability to explain complicated topics well is so cool. Seriously 🙂

Hehehe, thanks! 😀

Arche,

I love the graphs. Any figures on actual fuel consumption/demand in the Philippines?

Consumers everywhere react negatively towards a price increase. The intensity may vary but they’re pretty much the same, leaning on the negative. They may buy less or just simply stop buying a good. In the case of oil, there are limited substitutes. The industry can pretty much tell the world to go f#ck itself whenever it moves to protect margins.

From a business viewpoint, wage hikes will increase prices of goods and will eventually harm the workers that it tries to help.

The wage thing is trickier. Prices of goods increase because of adjusted margins caused by oil price increases or any other input price increase (including wages).

Wage earners are usually stuck in a single income stream situation and will cope by using alternatives to products they can’t afford, even gamble away nutrition. I think that’s why the market for instant noodles grew over the last two decades.

You can check some graphs here.

http://www.tradingeconomics.com/search.aspx?q=Philippine%20oil%20consumption&sa=Search&cx=partner-pub-3400948010513654:2035820411&cof=FORID:10&ie=UTF-8

Reacting negatively to a price increase is normal. However, people must stop differentiating prices from wages in order to satisfy themselves. By principle, they are the same. It’s only a matter of perspective; who is the producer and the consumer in consideration?

Yes, it’s a sad thing minimum wage earners are sacrificing nutrition to get by. The best recourse would be to make oil pricing more flexible by having in patterned on the global trend, while investing at new energy sources at the same time, like what the Asian Tigers are doing. However, the latter, which might be the most crucial factor, depends on the willingness of the government and the private sector.

We’re not even the biggest market for fuel in the region. The militants will grow old and have grey pubes before they can muscle any TNC into backing down with oil prices. Imagine if companies asked workers for a wage rollback. LOL.

The country can also go into studying ways for efficient use of its oil. In the long run, less is best.

The oligarchs are already moving in energy. SMC is in it, and so are the Lopezes. I’m not sure about other private sector players.

Exactly. The militants are fanatically defending an antiquated ideology, something that begs to be disposed of as soon as possible. Haha, I giggled at the wage rollback.

“The oligarchs are already moving in energy. SMC is in it, and so are the Lopezes. I’m not sure about other private sector players.”

Another market to monopolize, it seems. Which makes it all the more plausible to relax our market’s constraints to even out the playing field.

Arche, if I remember correctly there were two big blows to the oil and gas sector in the Philippines. The first was the dissolution of the Ministry of Energy during Cory’s time. The second was the sale of Petron to Saudi Aramco during FVR’s time.

Why government and business should not mix: it’s a no-brainer to put profits over public service, isn’t it? I hold the opinion that alternative energy sources research is hardly encouraged here because no company would want to spread itself too thin, and to make expenditures for R&D that won’t yield immediate results. It would be a nightmare for big oil companies for the Philippines to become self-sufficient in energy. What they’re doing is similar to what Russia is doing with natural gas to the rest of Europe, but on a smaller scale.

Milk the crude oil market till it bleeds, kumbaga. And bleeding we already are.

Indeed. No private entity has an incentive to embark on alternative energy research here, simply because it’s high-risk and will hardly yield any profits.

Moreover, our market and politics is conveniently set up in such a way that it can be easily “milked” by companies in cahoots with the government. An uncaring government who doesn’t give a damn about new energy, plus opportunist oligarchs under an insulated oil industry; who would even want to research on alternative energy?

It’s no wonder why we are left out in the race for new energy.

Kung ako pag pipiliin, hmm. siguro Price hike.

My insight about this is to lower the price but enhance the quality to get the higher profitability of a certain product. Ergo, the revenue has increase and this will provide a better payroll for workers.

I really appreciate the topic. It clarified much of the things that must be seen to allow a better perspective on how the Philippine economic system works. My only suggestion to the site is if some can conduct a grass-roots campaign of sort to inform the public. Information dissemination is key to actually have increased support to such movement. And hopefully, we can make it as understandable as much as possible to the masses. More power and God bless.